Term Insurance

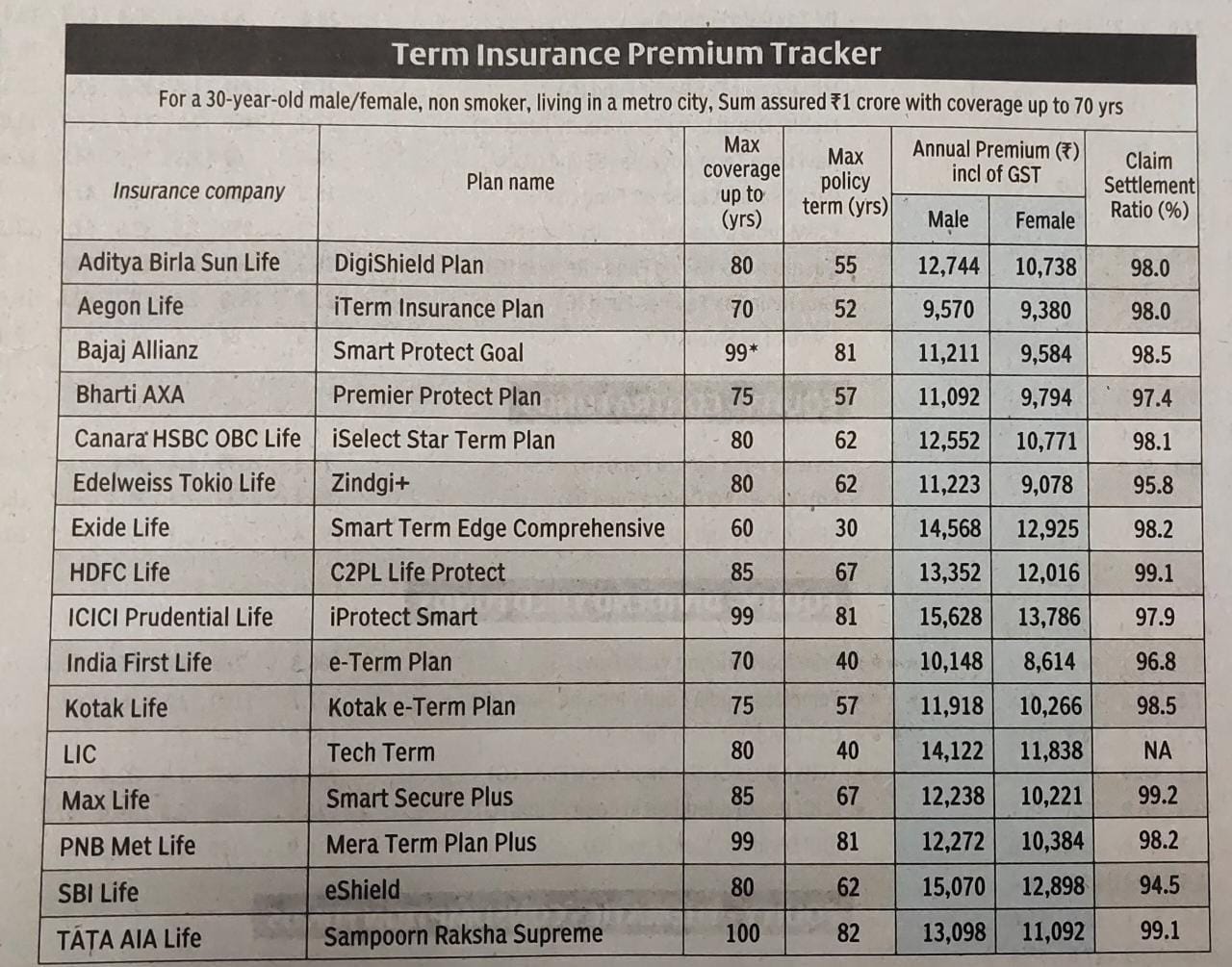

Term Life Insurance is one the most recommended product and most demanded products in the market. Let us understand the meaning of the term plan. It is also known as pure risk insurance or a pure term plan. The specialty of this product is you can buy decent insurance for the family at the most affordable price. The ideal age to buy the term plan is (25 years to 40 years) or the moment you join the company and start earning in case of salaried person and in case of professional when you have ascertained on paper income and documents. Higher the age premium becomes costly. Average Premium for 1 crore for age 30 years and policy term of 30 yrs ranges from 10000 to150000 annually. Add on riders available in the term plan are an accidental benefit rider, critical illness rider, and refund of premium also available under the policy.

Term plan company risk is limited only to the term selected by the policyholder and the amount is paid to the nominee only in the event of death of the policyholder during the policy term. In case of natural death, the basic sum assured is paid. If the accidental rider is selected then a double sum assured is paid. For Eg. Term Plan is for 1 Crore Sum assured and death happens during the policy term due to accident and accident rider is of 1 crore taken in the policy then 2 crore is payable to the family. But if death happens after the policy term is over no amount is payable to the nominee.

The premium of the term plan mainly depends on these important factors. Age of the person, period of the term plan, the profession of the person, category Smoker or Non Smoker, medical history, Income factor decides the eligibility of Sum assured offered by the company.

A term plan is suitable to cover your liabilities, act as collateral security in case of a business loan, housing loan. Grace period is 15 days as it high-risk plan and no claim payable if the grace period is over and there is a default in premium payment. Medical is required to activate your term plan in case policy gets deactivated or lapsed if the premium is not paid in time.

Documents required for the term plan are KYC documents like your Pan card, Adhar Card, 3 years ITR or Form 16, latest salary slips in case of a salaried employee, and bank statements in addition to the same. Previous insurance policy details, Nominee Name, age, and relation.Discharge summary in case of any medical history and Premium cheque.

- Child Education Plan

- Pension Plan

- Term Insurance

- ULIPS

- Senior Citizen Plan

- Single Investment Plan

- Health Insurance

- Corporate Insurance

- Mutual Funds